39 coupon rate bond formula

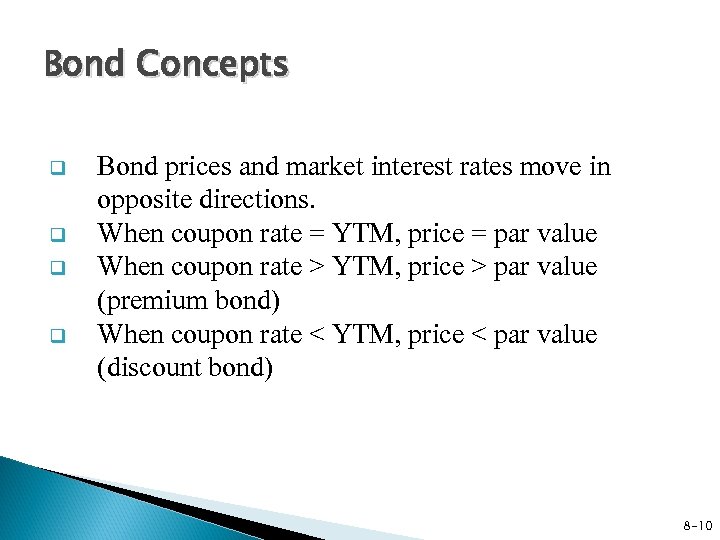

Coupon Bond Formula | Examples with Excel Template Calculate the market price of the bonds based on the new information. Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16. Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Amortization of Bond Discount: Definition, Calculation ... Example of Amortization of Bond Discount - Effective Interest Rate Method Lopez Co. has issued a bond equivalent to $10,000,000, for a time to maturity of 5 years. The coupon rate of the bond is 6%. This rate is lower than the current market rate of the bond discount.

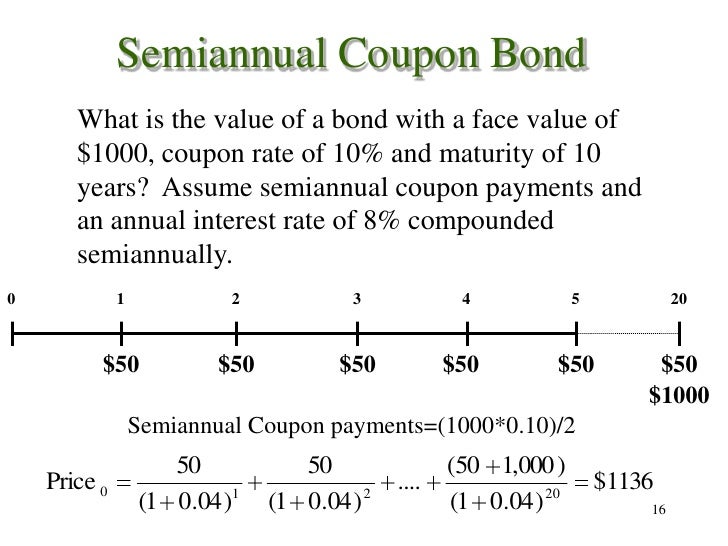

Excel formula: Bond valuation example | Exceljet The coupon rate is 7% so the bond will pay 7% of the $1,000 face value in interest every year, or $70. However, because interest is paid semiannually in two equal payments, there will be 6 coupon payments of $35 each. The $1,000 will be returned at maturity. Finally, the required rate of return (discount rate) is assumed to be 8%.

Coupon rate bond formula

How do I Calculate Zero Coupon Bond Yield? (with picture) Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the yield. It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond. The zero coupon bond yield helps investors decide whether to invest in bonds. Coupon Rate Formula | Calculator (Excel Template) Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon ... Coupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more " refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the principal amount when the bond matures. read more. In other words, it is the stated rate of interest paid on fixed income securities, primarily ...

Coupon rate bond formula. Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. Coupon Rate Definition - investopedia.com A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... › bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. Bond Pricing | Valuation | Formula | How to calculate with ... Calculate the price of a bond whose face value is $1000, the coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8. The following is the summary of bond pricing:

Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond. Bond Formulas - thismatter.com P + + P - - 2P 0. P 0 (Δy) 2. P 0 = Bond price. P - = Bond price when interest rate is incremented. P + = Bond price when interest rate is decremented. Δy = change in interest rate in decimal form. Note that this formula yields double the convexity as the Convexity Approximation Formula #1. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

What Is the Coupon Rate of a Bond? The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. › terms › cCoupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). What is Coupon Equivalent Rate? | IIFL Knowledge Center The investor can use the coupon equivalent rate formula to compare the bonds and know which can give you better returns. Using the formula, the results for the zero-coupon bond would be: CER ...

How to Calculate a Zero Coupon Bond Price | Double Entry ... n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) In this example the bondholder has to wait 10 years before they receive the face value of the bond.

Coupon Rate: Definition, Formula & Calculation - Video ... C = coupon rate i = annualized interest (or coupon) p = par value of bond Coupon Rate Calculation Example Let's look at an example. XYZ Company, the fictitious maker of widgets, is looking to...

How to Calculate the Bond Duration (example included ... FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years t3 = 1.5 years t4 = tn = 2 years

How to Calculate the Yield of a Zero Coupon Bond Using ... That's gonna allow us to calculate just that so let's jump into an example and I'll show you how it works. So let's say that you didn't know the yield on a five-year zero-coupon bond but you did know the forward rates here I've got the forward rates for the next five years so you've got these different forward rates here and you can essentially just plug them into this formula above and we can ...

Coupon Payment | Definition, Formula, Calculator & Example Formula. Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator.

› dictionary › dWhat Is Duration of a Bond? - TheStreet Definition - TheStreet Mar 22, 2022 · What Is Bond Duration? Definition, Formula & Examples. ... When a coupon is added to a bond, ... the more sensitive the bond is to interest rate changes, and thus, the more prone it is to interest ...

What Is Coupon Rate and How Do You Calculate It? Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100. $100 / $1,000 = 0.10. The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year.

Coupon Bond Formula | How to Calculate the Price of Coupon ... The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where

which equation illustrates the bond yield? Finally, the yield curve can be flat. But if an investor buys the bond at a premium, purchasing it at the current . Bond Yields and the Term Structure 1. This shows, lower the bon

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and; n is the number of years until maturity. Note that the formula above assumes that the interest rate Interest Rate An interest rate refers to the ...

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as. This formula will then become. By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top.

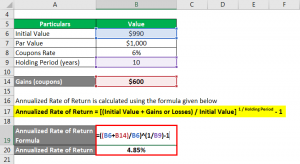

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Post a Comment for "39 coupon rate bond formula"