43 coupon rate on bonds

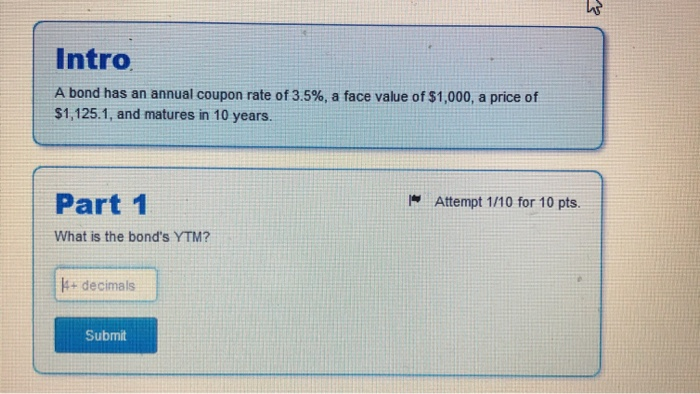

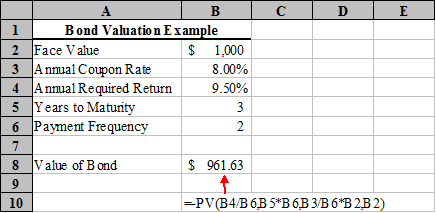

Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond ... Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon rate on bonds

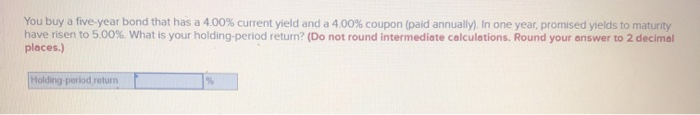

Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Compare Fixed Rate Bonds | MoneySuperMarket Fixed term bonds generally have minimum and maximum opening deposits. Some fixed rate bond accounts can be opened with as little as £1, for example, but typical minimum deposits start at about £500. Maximum deposits can go into millions, but remember only the first £85,000 will be protected by the FSCS (where applicable). You may find the ... Floating Rate Bonds: Characteristics, Rate, and Important Floating Rate Bonds offer certain benefits to both investors and issuers against the traditional fixed-rate bonds. Investors’ coupon payments adjust with changes in interest rates; As the floating rate is a combination of the Fed rate or LIBOR, it eliminates the volatility risk for investors;

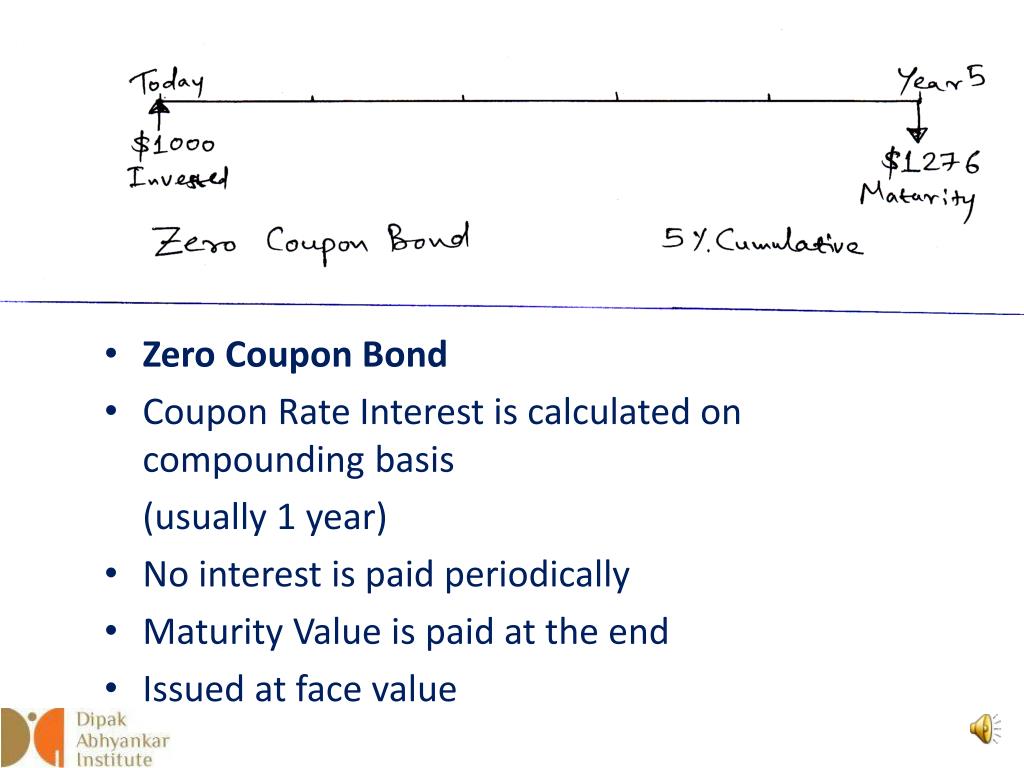

Coupon rate on bonds. The One-Minute Guide to Zero Coupon Bonds | FINRA.org That said, zero-coupon bonds carry various types of risk. Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. What Is the Coupon Rate of a Bond? - The Balance 18/11/2021 · A bond’s coupon rate is the fixed dollar value of the annual interest the bondholder will receive. It is stated as a percentage of the bond’s face value. ... Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years. Coupon Rate of a Bond - WallStreetMojo Coupon Rate is mostly applied to bonds and it is usually the ROI (rate of interest) that is paid on the face value of a bond by the issuers of bond and it is also used to calculate the repayment amount that is made by GIS (guaranteed income security). Table of contents. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified ...

Floating Rate Bonds: Characteristics, Rate, and Important Floating Rate Bonds offer certain benefits to both investors and issuers against the traditional fixed-rate bonds. Investors’ coupon payments adjust with changes in interest rates; As the floating rate is a combination of the Fed rate or LIBOR, it eliminates the volatility risk for investors; Compare Fixed Rate Bonds | MoneySuperMarket Fixed term bonds generally have minimum and maximum opening deposits. Some fixed rate bond accounts can be opened with as little as £1, for example, but typical minimum deposits start at about £500. Maximum deposits can go into millions, but remember only the first £85,000 will be protected by the FSCS (where applicable). You may find the ... Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Post a Comment for "43 coupon rate on bonds"