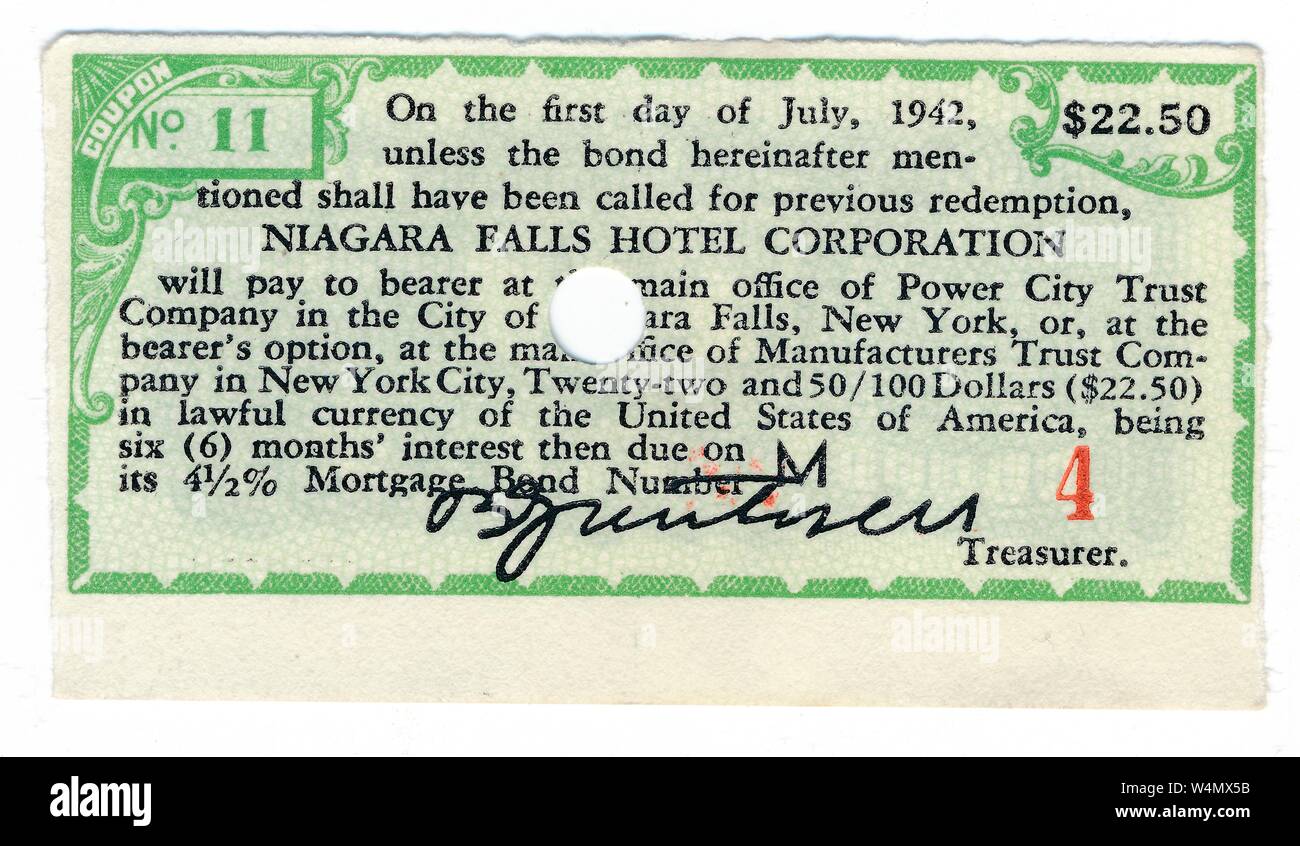

44 a bond's coupon rate

Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ... Coupon Rate: Formula and Bond Calculation (Step-by-Step) The coupon rate, or nominal yield, is the rate of interest paid to a bondholder by the issuer. The pricing of the coupon on a bond issuance is used to calculate ...

What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 ... A bond's coupon rate is the fixed dollar value of the annual interest the bondholder will receive. It is stated as a percentage of the ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

A bond's coupon rate

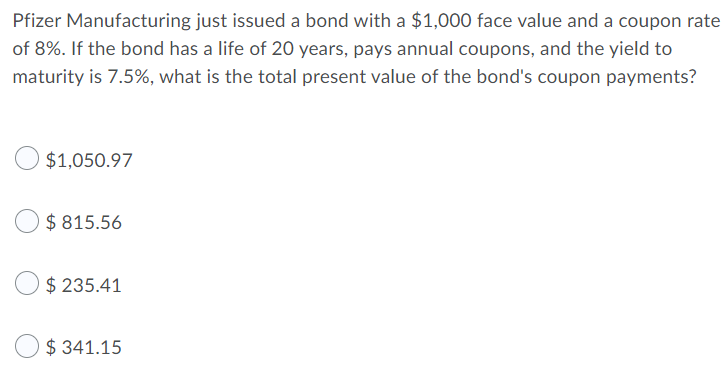

Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... All types of bonds pay interest to the bondholder. The amount of interest is known as the coupon rate. Unlike other financial products, ... What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

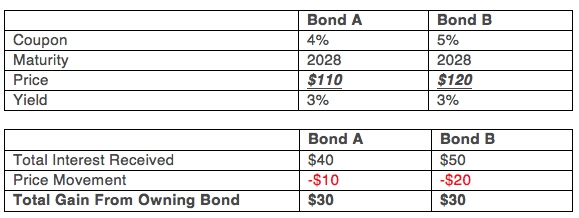

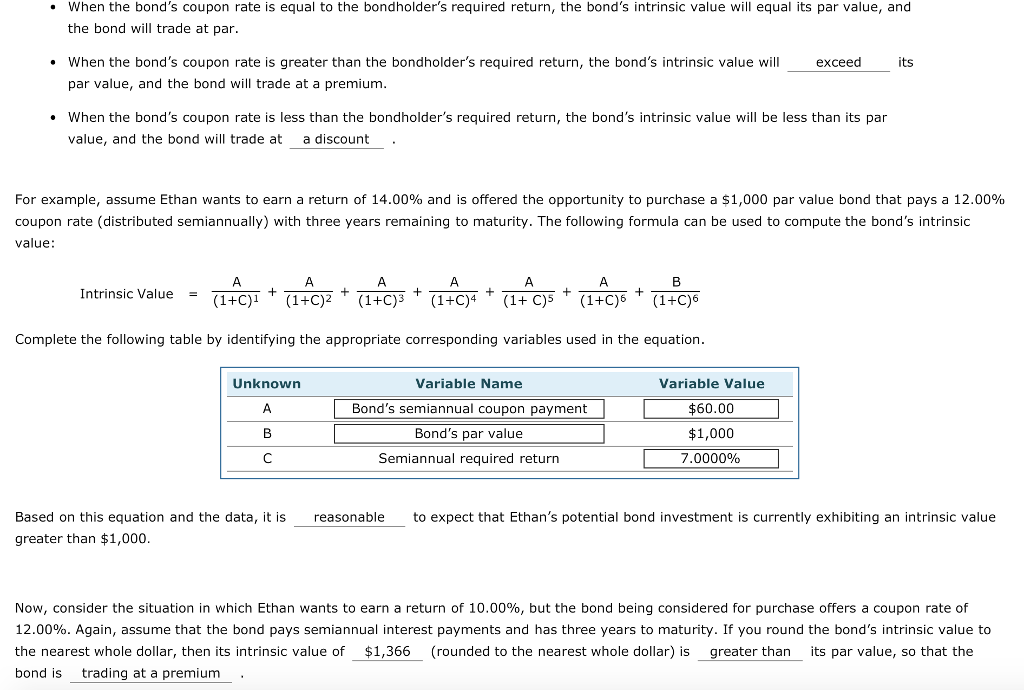

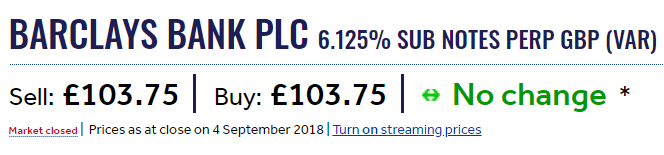

A bond's coupon rate. Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or ... What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... When Interest rates Go up, Prices of Fixed-rate Bonds Fall - SEC.gov interest rates. Interest rate risk is common to all bonds, particularly bonds with a fixed rate coupon, even u.s. treasury bonds. (Many bonds pay a fixed ... Concept 82: Relationships among a Bond’s Price, Coupon Rate ... Relationship with bond’s price. A bond’s price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond’s price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount.

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. Types of Coupon Rates in Fixed Income Securities Fixed-Rate: The simplest form of coupon rate offered by bonds is called a fixed-rate bond. · Floating Rate: Floating rate coupon payments bonds are different ...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders ... Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... All types of bonds pay interest to the bondholder. The amount of interest is known as the coupon rate. Unlike other financial products, ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 a bond's coupon rate"