44 perpetual zero coupon bond

Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice. Helicopter Money and Zero Coupon Perpentual bonds PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity.

en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006.

Perpetual zero coupon bond

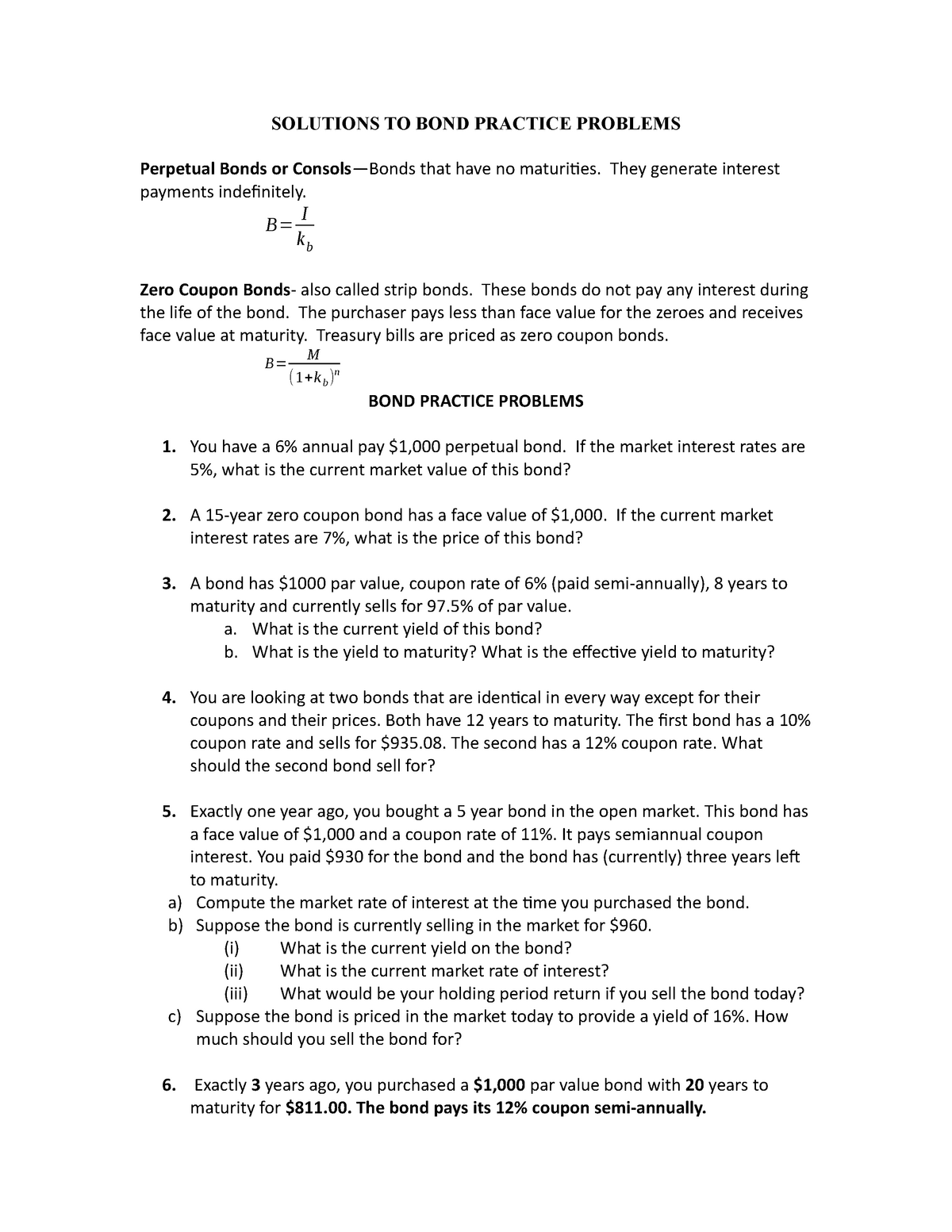

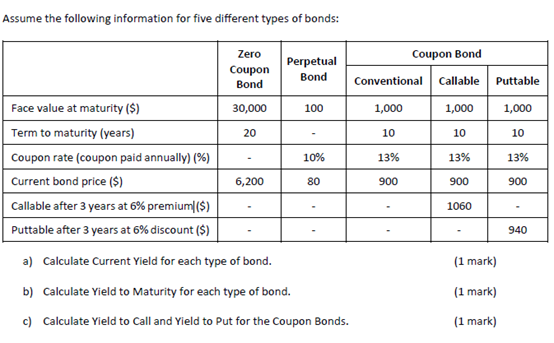

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ... Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation. › bondsSecondary Bonds Market – Types of BondsIndia You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds.

Perpetual zero coupon bond. › content › 336a396e-8bb7-4464-b9f6-9bfLyft wants a free ride from California’s richest | Financial ... Oct 11, 2022 · This would help the company satisfy a state law that 90 per cent of the miles driven by its fleet are in zero-emission vehicles by 2030. It would also lower the operating costs of its 300,000 cash ... What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... Mr. Tee is looking to purchase a zero-coupon bond with a face value of $50 and 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. However, to calculate the price that needs to be paid for the bond today, the following formula is used: Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. Perpetual bond - Wikipedia A perpetual bond, also known colloquially as a perpetual or perp, is a bond with no maturity date, [1] therefore allowing it to be treated as equity, not as debt. Issuers pay coupons on perpetual bonds forever, and they do not have to redeem the principal. Perpetual bond cash flows are, therefore, those of a perpetuity . Contents

What Is a Perpetual Bond? - The Balance A perpetual bond is a rare type of bond that offers regular interest payments indefinitely but doesn't have a maturity date. 1 A bond is a loan investors make to a corporation, the federal government, a government agency, or a municipality. Most bonds offer investors regular fixed interest payments called " coupons " throughout the bond's lifespan. Zero-Coupon Bond - The Investors Book Coupon Payment Frequency: The intervals at which the payment of interest is made on the bonds is termed as coupon payment frequency. It is paid semi-annually or annually and even monthly or quarterly in some cases. Advantages of Zero-Coupon Bond. A zero-coupon bond is a secured form of investment when done for the long term. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for... Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Features of Zero-Coupon Bond. The difference between the purchase price of a zero-coupon bond and the par value, indicates the investor's return. Zero Coupon Bonds have no reinvestment risk however they carry interest rate risk. The accumulated interest is paid at the time of maturity. Includes a maturity period of 10 to 15 years.

› databases › questiaQuestia - Gale Questia. After more than twenty years, Questia is discontinuing operations as of Monday, December 21, 2020. BOLI - The "Zero Coupon Perpetual Bond" - nfp.com BOLI is a bond — a "zero coupon perpetual bond." What's fascinating about this bond is that neither ABC Insurance Company nor XYZ Insurance Company, the issuer, sets the price for the bond. It's really the federal government, as tax code (IRC 7702) sets the parameters for the price. And market interest rates have no influence on the price. Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages So, for example, assume that you invested in a perpetual bond with a par value of $1,000 by purchasing the bond at a discounted price of $950. You receive a total of $80 per year in coupon payments. Current Yield = [80 / 950] * 100 = 0.0842 * 100 = 8.42% The current yield from the bond is 8.42%. Related Readings What is the difference between a zero-coupon bond and a regular ... - Quora Answer (1 of 6): Hello, The difference between a regular bond and a zero-coupon bonds, is that the former pays bondholders interest, while the latter does not issue such interest payments, otherwise known as coupons. Instead, zero-coupon bondholders merely receive the face value of the bond when...

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Zero-Coupon Bonds and Taxes Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses...

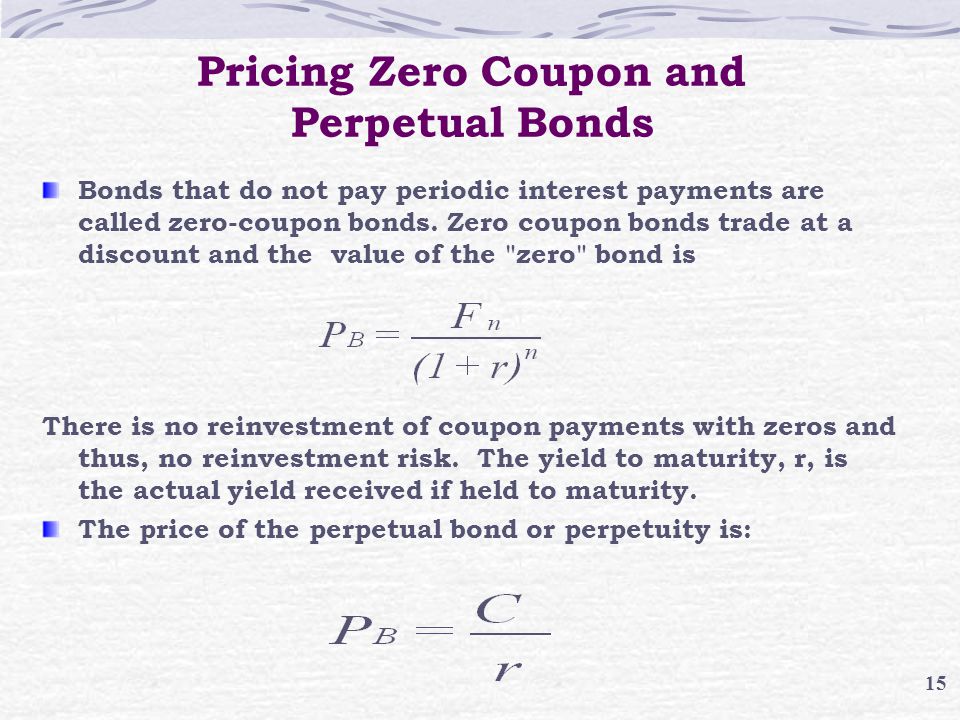

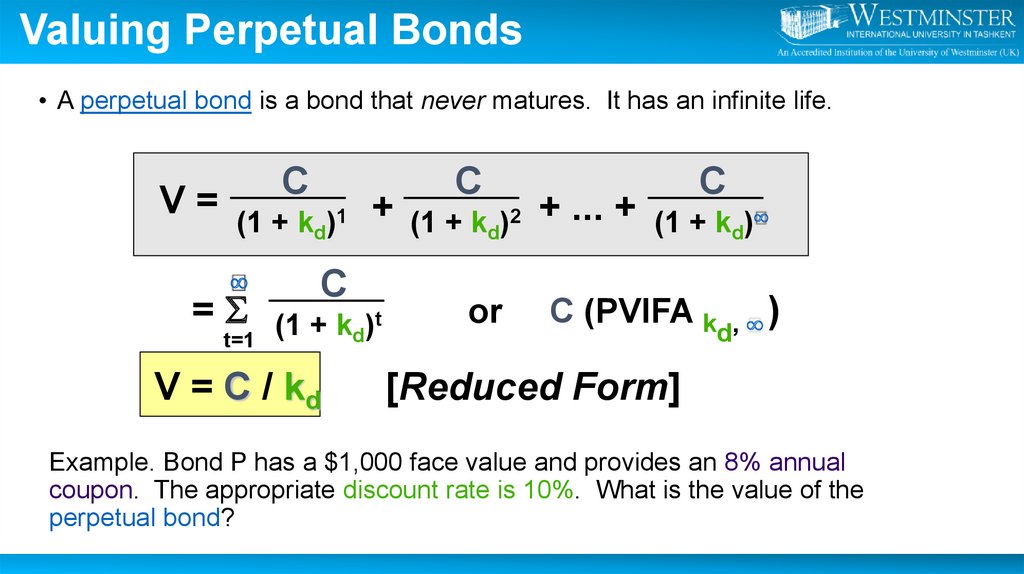

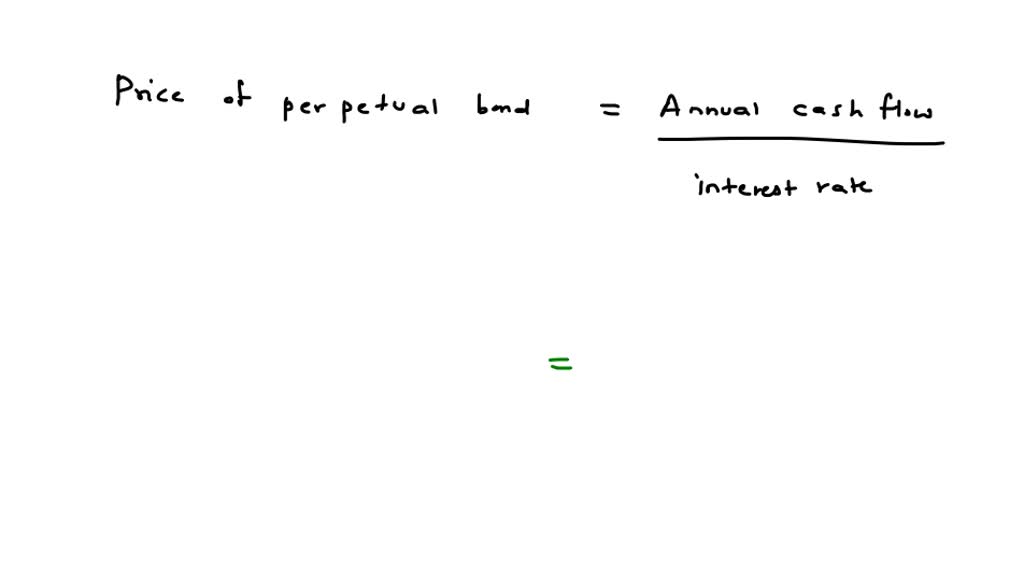

An Overview of Perpetual Bonds - Investopedia The price of a perpetual bond is, therefore, the fixed interest payment, or coupon amount, divided by the discount rate, with the discount rate representing the speed at which money loses...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

All the 21 Types of Bonds | General Features and Valuation | eFM Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). ... Perpetual Bonds. Perpetual bonds are types of bonds that pay a coupon rate on the face value till ...

International bonds: Odebrecht Oil & Gas Finance, 0% perp., USD Perpetual, Guaranteed, Trace-eligible, Zero-coupon bonds, Senior Unsecured. Status. Early redeemed. ... Zero-coupon bonds Senior Unsecured Registered Documentary bonds Guaranteed ...

Zero-coupon perpetual bonds: this April Fool is no joke The US Treasury is considering introducing zero-coupon perpetual bonds About ten years ago I wrote an article recommending that the US Treasury should issue zero-coupon perpetual bonds...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

Chancellor: Zero-coupon bonds are not a joke | Reuters The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall...

Perpetual Bonds - How Do They Work? - Accounting Hub The present value of perpetual bonds can be calculated with the present value formula of perpetuity. Present Value = D/r Where: D = annual coupon payment r= coupon rate (annual) For example, suppose a perpetual bond pays $ 50,000 in annual coupon payments and has a coupon rate of 5%. Present value = 15,000/0.05 = $ 300,000.

time.com › nextadvisorHome | NextAdvisor with TIME The I Bond Rate Fell Below 7%. We Answer Your Questions 7 min read. 4 Ways the Fed’s Interest Rate Hikes Directly Affect Your Money — and What You Can Do About It 9 min read.

Impossible Finance — The Zero Coupon Perpetual Bond - Medium D = Coupon per period. r = discount rate. n = number of periods i.e. infinity. This is a very simple calculation for a Zero Coupon Perpetual bond. The answer is zero because D = 0. Zero divided by anything is zero. Summing up an infinite stream of zeros, strangely enough is also zero.

fortune.comFortune - Fortune 500 Daily & Breaking Business News | Fortune Unrivaled access, premier storytelling, and the best of business since 1930.

What is the fair price of a perpetual zero-coupon bond? - Quora But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." The more thoughtful answer is that a perpetual zero-coupon bond has no discounted cash flow value, but can have transaction or some other type of value. 910 views View upvotes 11

What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is...

Perpetual Bond: Definition, Example, Formula To Calculate Value Formula for the Present Value of a Perpetual Bond Present value = D / r Where: D = periodic coupon payment of the bond r = discount rate applied to the bond For example, if a perpetual...

Is fiat currency the same as a perpetual zero coupon bond? Answer (1 of 4): representative money, like gold standard money, can be considered a debt in that the hold is owed that amount of gold and a bond is something one is paid an increased value on over time if with the gold standard there is still inflation, which there usually was, then as the val...

› 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

› bondsSecondary Bonds Market – Types of BondsIndia You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds.

Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ...

Post a Comment for "44 perpetual zero coupon bond"