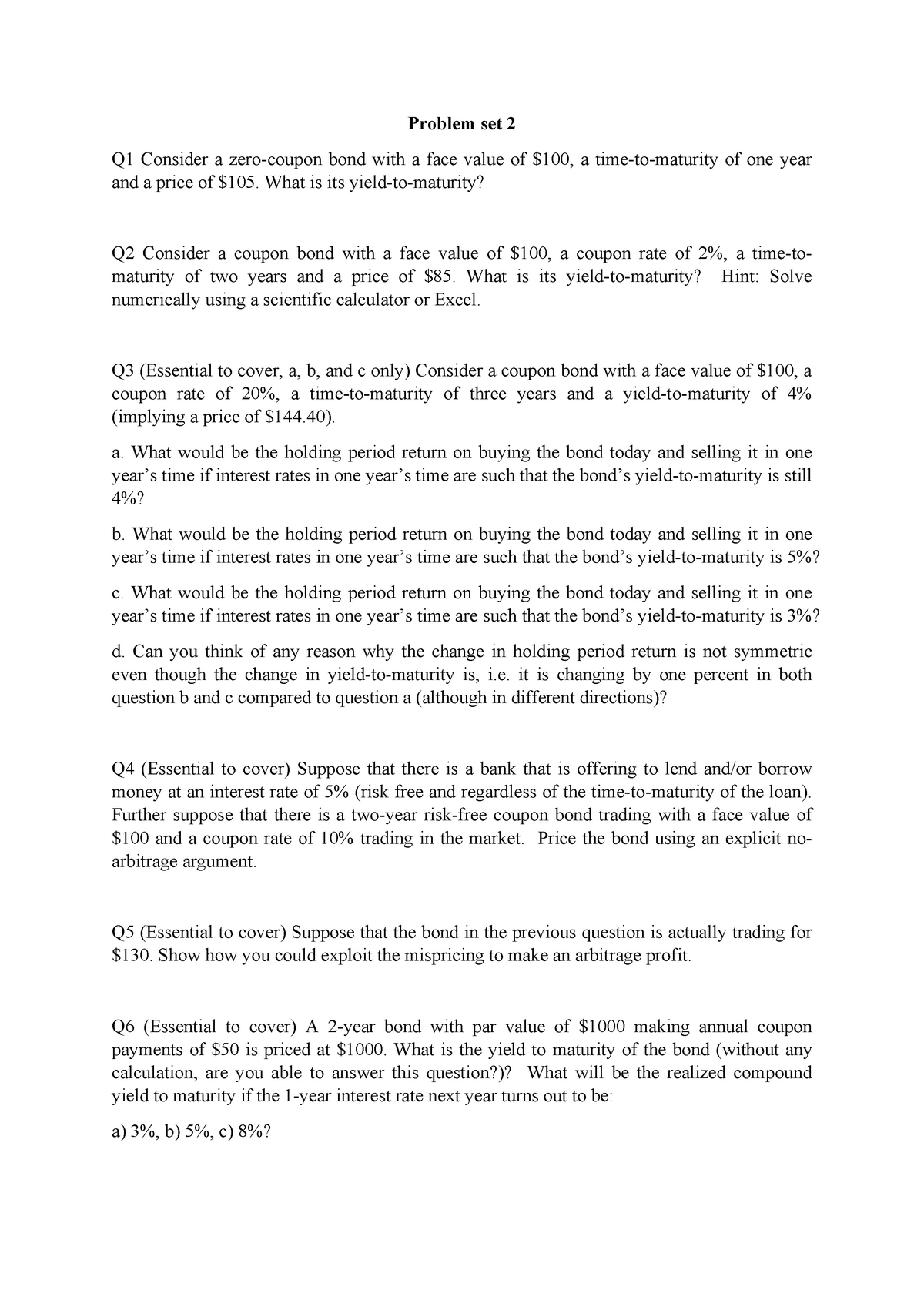

43 yield to maturity of coupon bond

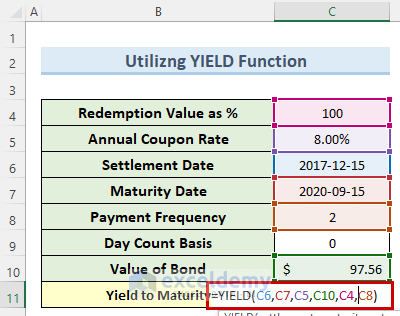

Key Differences: Bond Price vs. Yield - SmartAsset Coupon (or Nominal) Yield - Suppose someone buys a one-year bond with a face value of $1,000 bond and an annual coupon of $50. Holding that bond for one year (to maturity) would result in a yield of 5%. That would be its coupon yield or nominal yield. Current Yield - But now consider how yield changes if the price of that same bond falls ... YIELD function - Microsoft Support Use YIELD to calculate bond yield. Syntax. YIELD(settlement, maturity, rate, pr, redemption, frequency, [basis]) ... The settlement date is the date a buyer purchases a coupon, such as a bond. The maturity date is the date when a coupon expires. For example, suppose a 30-year bond is issued on January 1, 2008, and is purchased by a buyer six ...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Yield to maturity of coupon bond

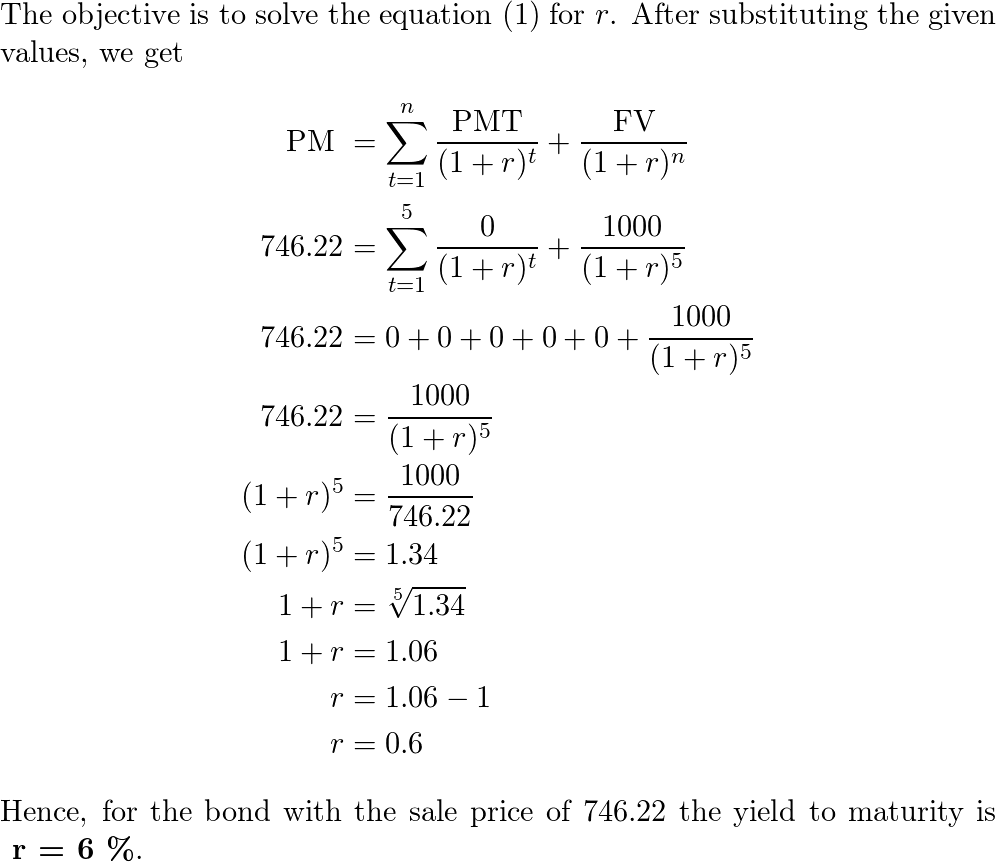

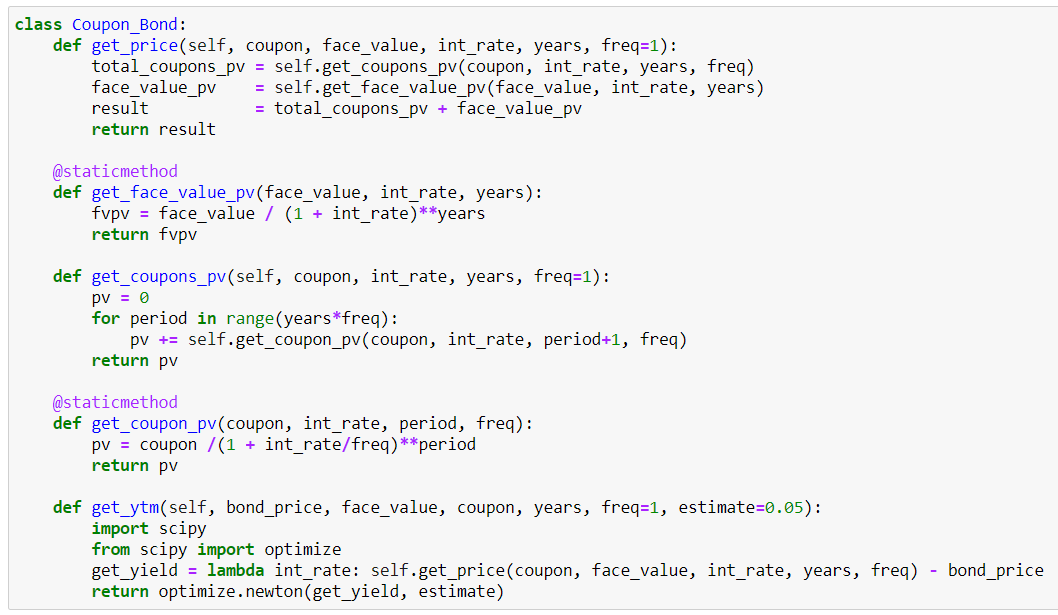

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Yield to Maturity (YTM): Formula and Bond Calculation - Wall Street Prep In our hypothetical scenario, the following assumptions regarding the bond will be used to calculate the yield-to-maturity (YTM). Face Value of Bond (FV) = $1,000 Annual Coupon Rate (%) = 6.0% Number of Years to Maturity = 10 Years Price of Bond (PV) = $1,050 We'll also assume that the bond issues semi-annual coupon payments. Step 2. home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

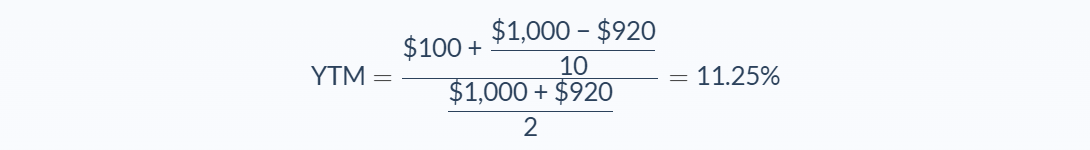

Yield to maturity of coupon bond. Yield to Maturity (YTM) Definition & Example | InvestingAnswers Yield to Maturity Formula The formula to calculate YTM is as follows: Yield to Maturity Example Let's say you're thinking about purchasing a bond that's priced at $1,000 and has a face value of $1,500. The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia If this same bond is purchased for $800, then the current yield becomes 7.5% because the $60 annual coupon payments represent a larger share of the purchase price. Special Considerations A... Yield To Maturity Calculator Zero Coupon - bizimkonak.com How to Calculate Yield to Maturity of a Zero-Coupon … CODES (2 days ago) Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures. › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity Calculator In case a bond's coupon rate = YTM, THEN the bond is selling at par. In case a bond's coupon rate < YTM, THEN the bond is selling at a discount. Example of a calculation. Let's assume a bond with the following characteristics: - face value = $100,000 - current clean price = $140,000 - yearly coupon payment = $10,000 - years to maturity = 10.

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow Once you have that information, plug it into the formula , where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. [5] For example, suppose your purchased a $100 bond for $95.92 that pays a 5 percent interest rate every six months for 30 months. › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate bond has a coupon that represents a fixed percentage of its par value. › ask › answersCurrent Yield vs. Yield to Maturity - Investopedia Oct 12, 2022 · Bond Yield As a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ... › financial › bond-yieldBond Yield Calculator - CalculateStuff.com How to Calculate Yield to Maturity. Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity.

Yield to Maturity Calculator | YTM Calculator The yield to maturity is the annualized rate of return using any appreciation or depreciation from the bond, as well as annual coupon payments. Total Coupon Cash Flow: The total cash flow from the interest or coupon payments received by the investor over the "years to maturity."

Bond Yield to Maturity Calculator for Comparing Bonds So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate bond has a coupon that represents a fixed percentage of its par value.

A European bond has a par value of 1000 Euros, a coupon rate of 4.5 percent and a yield to maturity of 3.2 percent. The bond has 19 years to maturity. Coupons are made annually. What is the value of ...

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same...

› terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

A newly issued 20-year maturity, zero-coupon bond is | Chegg.com Expert Answer. A newly issued 20-year maturity, zero-coupon bond is issued with a yield to maturity of 7.0% and face value $1,000. Find the imputed interest income in (a) the first year; (b) the second year; and (c) the last year of the bond's life. Assume annual coupon payments. (Round your answers to 2 decimal places.)

Yield to maturity - Wikipedia For the $99.44 investment, the bond investor will receive $105 and therefore the yield to maturity is 5.56 / 99.44 for 5.59% in the one year time period. Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105.

Understanding Coupon Rate and Yield to Maturity of Bonds The Yield to Maturity is a rate of return that assumes that the buyer of the bond will hold the security until its maturity date and incorporates the rise or fall of market interest rates. This will be a bit technical. Let's see what happens to your bond when interest rates in the market move.

Maturity: Definition, How Maturity Dates Are Used, and Examples Apr 18, 2022 · Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed or it will cease to exist. The term is commonly used for deposits ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600 Par Value: $1000 Years to Maturity: 3 Annual Coupon Rate: 0% Coupon Frequency: 0x a Year Price = (Present Value / Face Value) ^ (1/n) - 1 = (1000 / 600) ^ (1 / 3) - 1= 1.6666... ^ (1/3) - 1 = 18.563%

Current Yield vs. Yield to Maturity - Investopedia Oct 12, 2022 · Bond Yield As a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ...

Yield to Maturity Calculator | Good Calculators Solution: The yearly coupon payment is $1000 × 7% = $70, using the formula above, we get: CY = 70 / 800 * 100 CY = 8.75%, The Current Yield is 8.75% The calculator uses the following formula to calculate the yield to maturity: P = C× (1 + r) -1 + C× (1 + r) -2 + . . . + C× (1 + r) -Y + B× (1 + r) -Y Where: P is the price of a bond,

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Consider a coupon bond that has a 900 par value and a coupon rate of 6 %. The bond is currently selling for 860.15 and has two years to maturity. What is the bond's yield to maturity (YTM)?

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds …

Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Bond Yield Calculator - CalculateStuff.com How to Calculate Yield to Maturity. Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity.

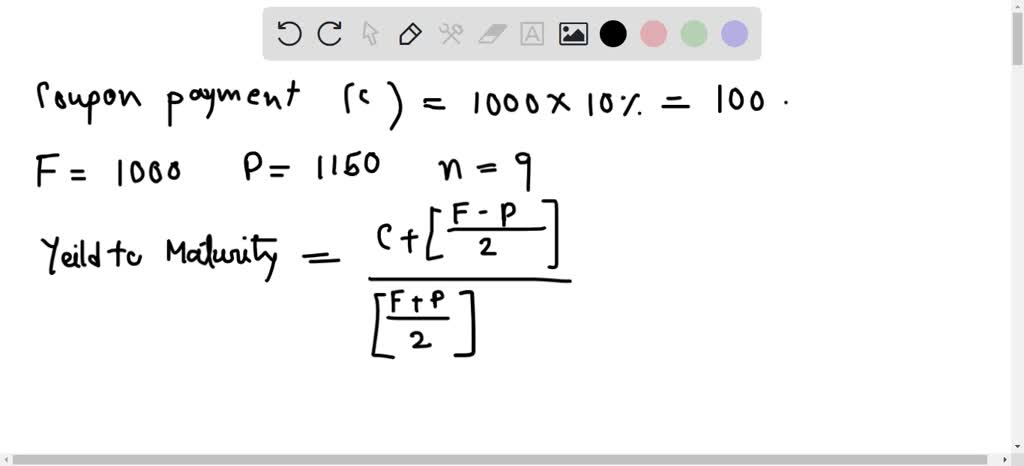

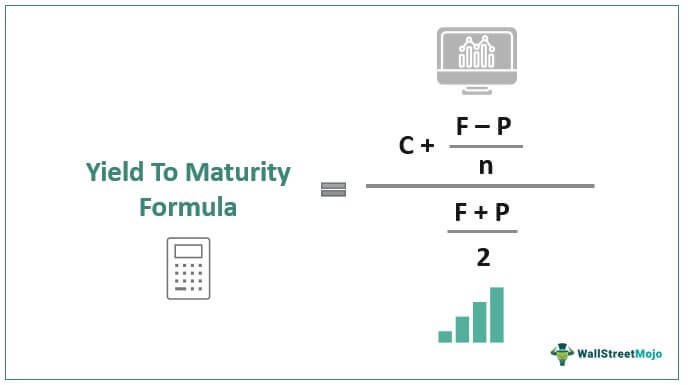

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates, etc, Please provide us with an attribution link The formula below calculates the bond's present value.

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are …

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Yield to Maturity (YTM): Formula and Bond Calculation - Wall Street Prep In our hypothetical scenario, the following assumptions regarding the bond will be used to calculate the yield-to-maturity (YTM). Face Value of Bond (FV) = $1,000 Annual Coupon Rate (%) = 6.0% Number of Years to Maturity = 10 Years Price of Bond (PV) = $1,050 We'll also assume that the bond issues semi-annual coupon payments. Step 2.

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

![PDF] Yield to Maturity Is Always Received as Promised: A Reply](https://i1.rgstatic.net/publication/228510503_Yield_to_Maturity_Is_Always_Received_as_Promised_A_Reply/links/00b7d5182ee3b9fafb000000/largepreview.png)

Post a Comment for "43 yield to maturity of coupon bond"