42 difference between coupon rate and market rate

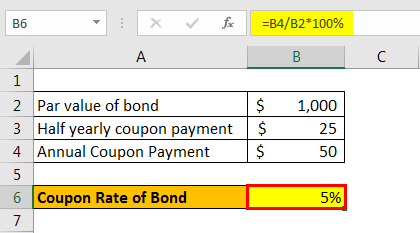

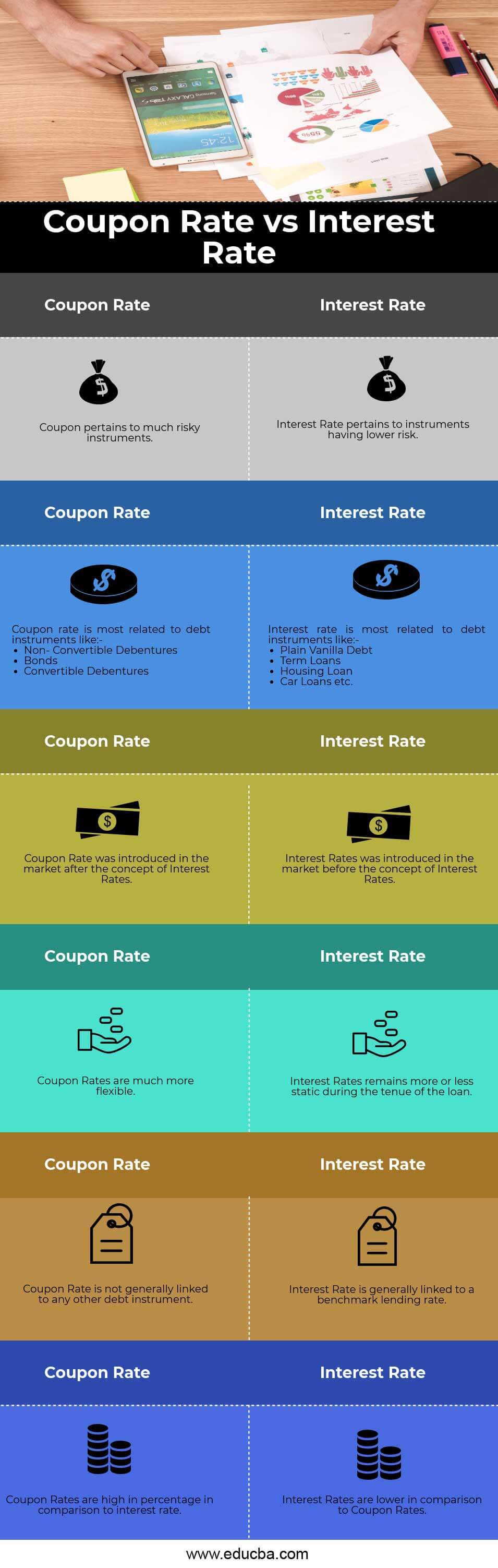

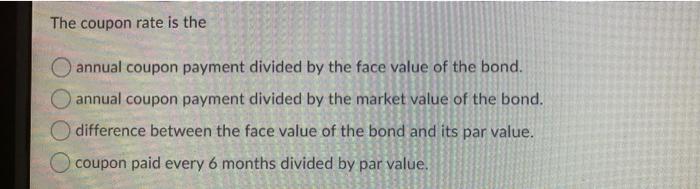

Coupon Rate vs Interest Rate | Top 8 Best Differences (with ... Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ... Home | NextAdvisor with TIME Refi Rates Today, November 2, 2022 | Refinance Rate Remains Above 7% as Fed Prepare for Rate Hike new 6 min read Today’s National Mortgage Rates, November 2, 2022 | Mortgage Rates Top 7.2% as ...

The San Diego Union-Tribune - San Diego, California ... Nov 01, 2022 · The nearly 100-year-old building has fallen into extreme disrepair and its owner was ordered to clean up and secure the site.

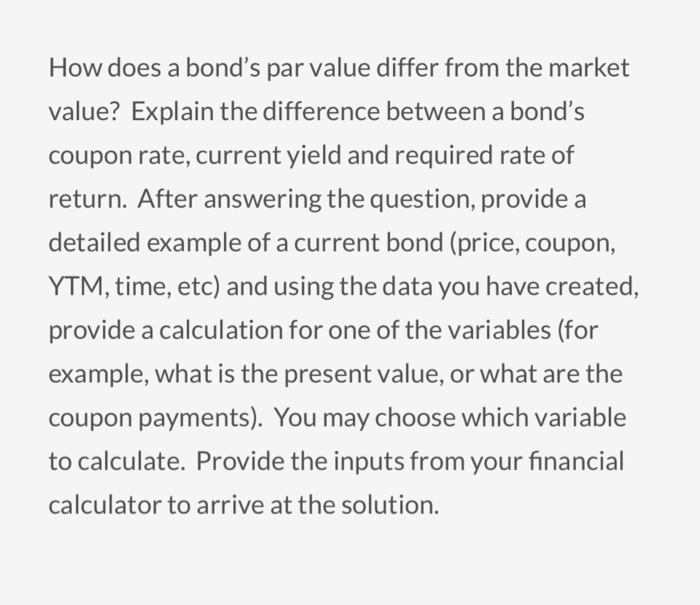

Difference between coupon rate and market rate

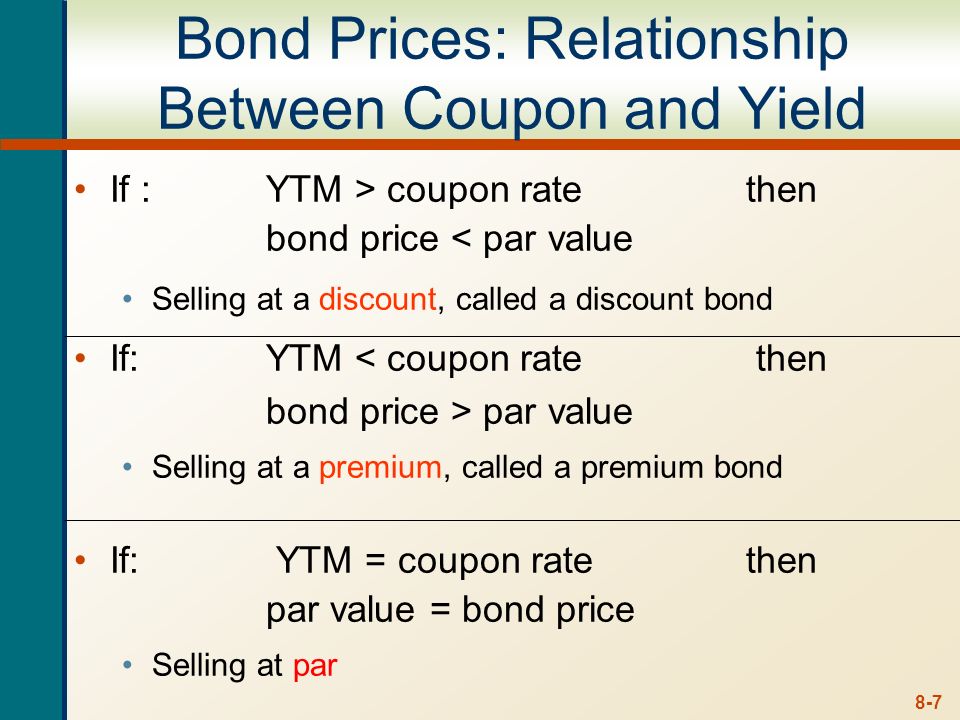

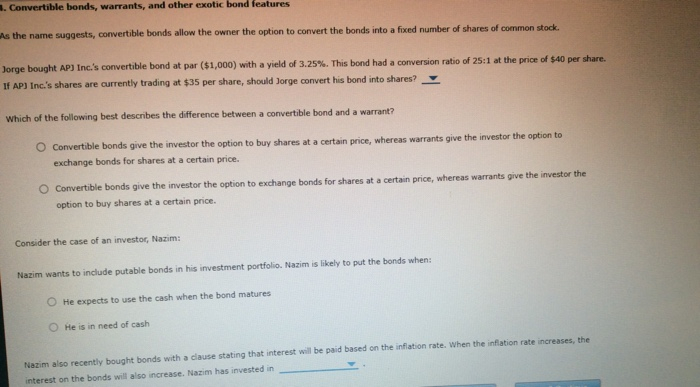

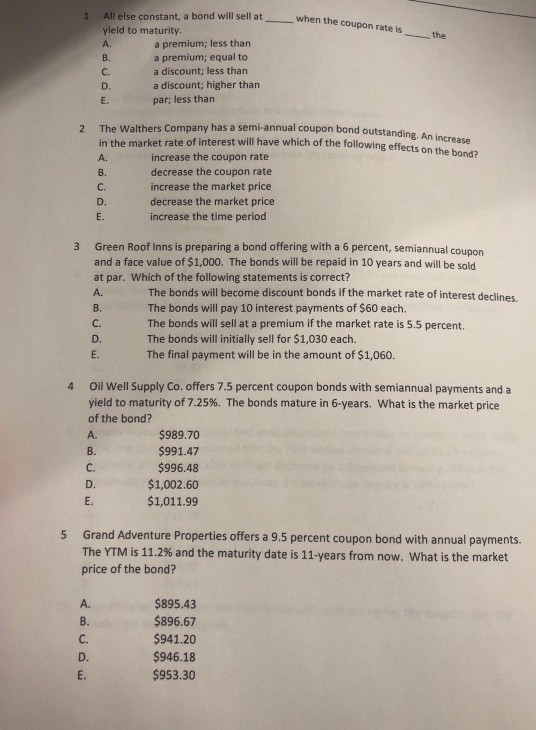

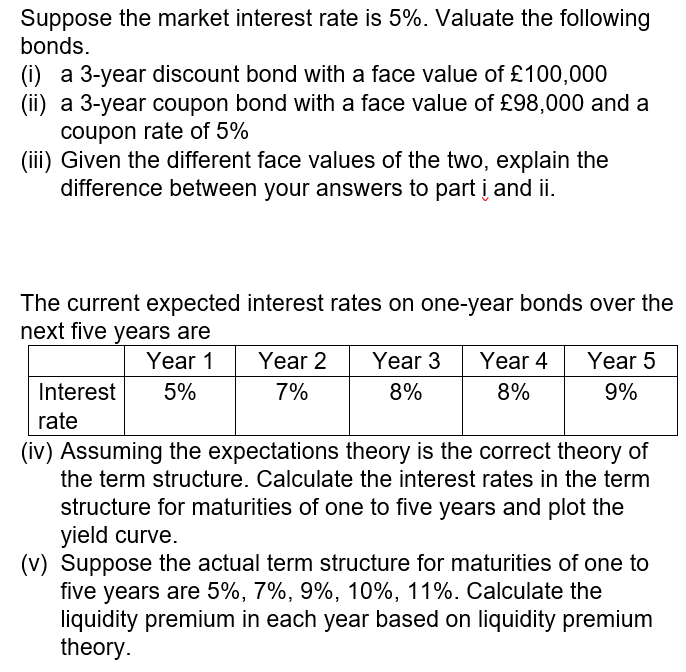

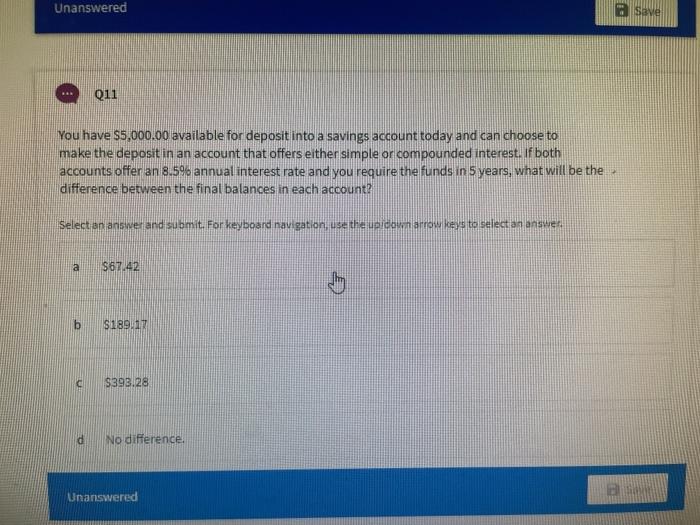

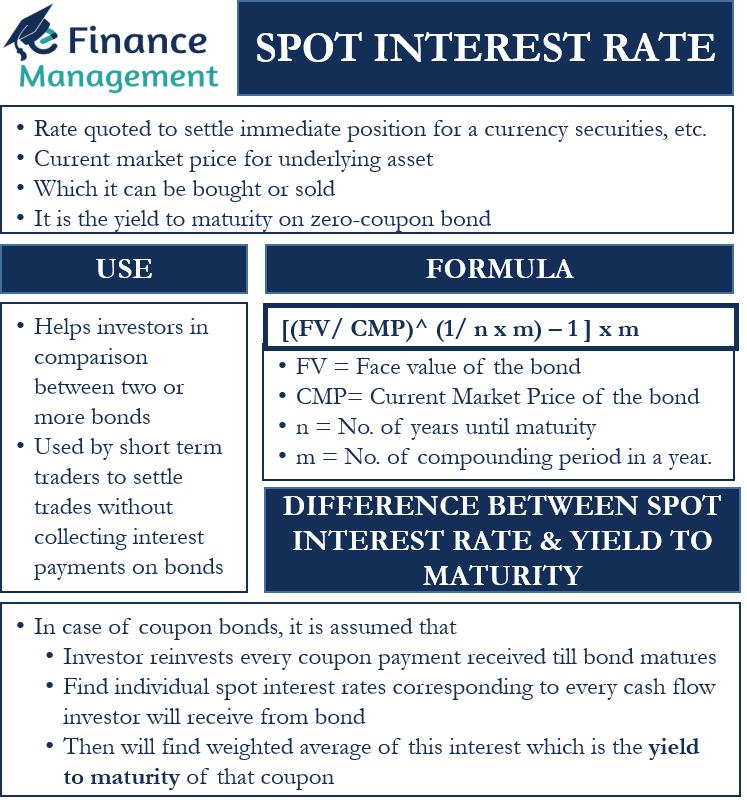

Interest - Wikipedia In economics, the rate of interest is the price of credit, and it plays the role of the cost of capital. In a free market economy, interest rates are subject to the law of supply and demand of the money supply, and one explanation of the tendency of interest rates to be generally greater than zero is the scarcity of loanable funds. What Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · When a bond's yield differs from the coupon rate, this means the bond is either trading at a premium or a discount to incorporate changes in market condition since the issuance of the bond.

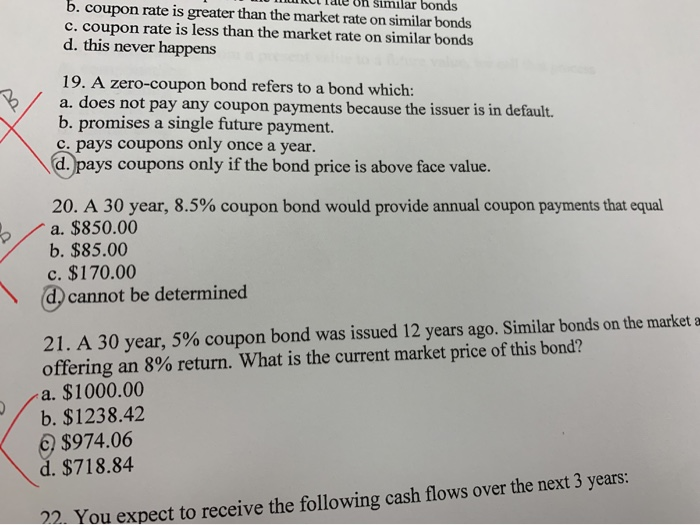

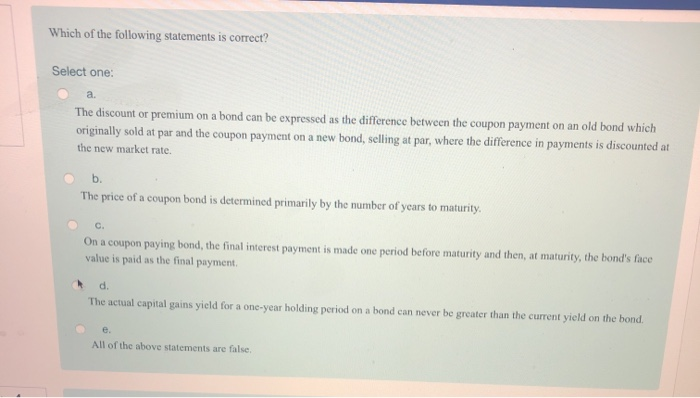

Difference between coupon rate and market rate. Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · When the prevailing market rate of interest is higher than the coupon rate—say there's a 7% interest rate and a bond coupon rate of just 5%—the price of the bond tends to drop on the open ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · When a bond's yield differs from the coupon rate, this means the bond is either trading at a premium or a discount to incorporate changes in market condition since the issuance of the bond. What Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... Interest - Wikipedia In economics, the rate of interest is the price of credit, and it plays the role of the cost of capital. In a free market economy, interest rates are subject to the law of supply and demand of the money supply, and one explanation of the tendency of interest rates to be generally greater than zero is the scarcity of loanable funds.

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)

Post a Comment for "42 difference between coupon rate and market rate"